NOTE: This infographic is part of an educational series on the various investment instruments available for funding a business. Some portions of the information provided may be outdated due to regulatory or other changes. Readers are advised to seek help from local legal, tax or other consultants to be aware of the latest developments within their country before acting on the information provided.

Frequently Asked Questions (FAQs) on Compulsory Convertible Preference Shares (CCPS)

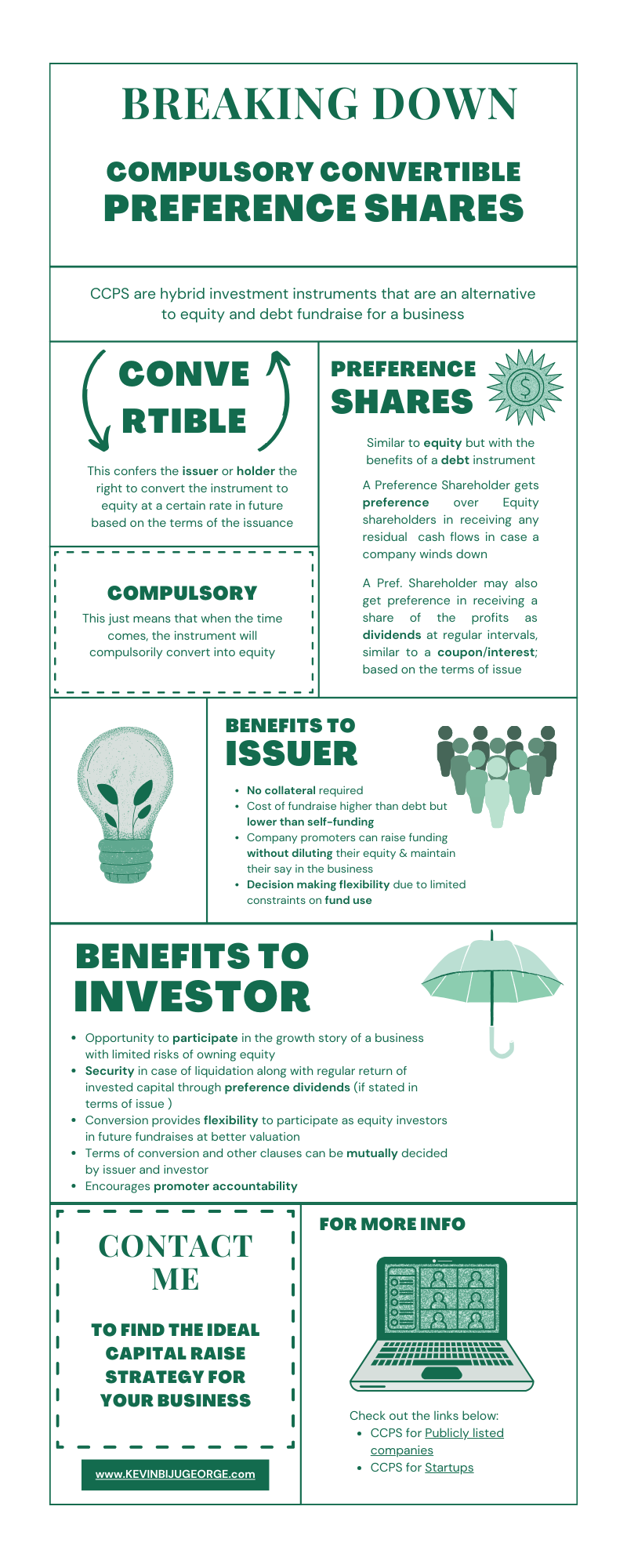

What are Compulsory Convertible Preference Shares (CCPS)?

CCPS are hybrid instruments with characteristics of both equity and debt that are increasingly becoming a preferred investment instrument for high net worth and Private Equity (PE) investors to fund early-stage companies. An investor that owns CCPS is known as a CCP Shareholder.

How does it work?

A company’s cash flows are distributed in increasing order as per the risk a capital provider bears in the company. Debtholders bear the least risk comparatively, because they have recourse to the assets of the company that are provided to them as collateral. They also receive a predetermined rate of return on their investment, also known as coupon or interest. Hence their returns from investment are capped to the extent of the collateral value and money received as coupons. Equity shareholders, on the other hand, bear the most risk and hence receive the highest return if the company is successful.

A CCP Shareholder sits somewhere in between the two. To understand the term CCPS, it is suggested to understand the terms ‘Compulsory Convertible’ and ‘Preference Share’ separately. Preference Shares are like Equity investments in that they are an opportunity to participate in the future profits of a company. Preference Shareholders are considered part owners of the business. However, in most cases, they do not have voting rights on par with common Equity shareholders. In exchange for giving up their voting rights, Preference Shareholders receive preferential rights over Equity shareholders; thereby bearing lower risk than the latter. This is the reason for the prefix “preference”.

What does ‘Preference’ mean?

Laid within the Terms of a CCPS Issue (a legal document describing the terms & conditions associated with the issue of CCPS, often known as a CCPS Subscription Agreement or Private Placement Memorandum) are preferential rights over Equity shares that limit the risk borne by a CCP Shareholder. Some of these rights are described as follows:

In case a company goes bankrupt and liquidates its assets, after repaying any dues to debt holders, any residual cash flows are preferentially allocated first to Preference Shareholders before passing on to Equity shareholders.

When a company is successful, a Preference Shareholder is ‘preferred’ while allocating dividends (if stated previously in the Terms of Issue; known as Preference Dividend) before dividends are declared for Equity Shareholders.

What does ‘Compulsory Convertible’ mean?

As per the Terms of Issue, Compulsory Convertible instruments are stated to ‘convert’ by compulsion into the common Equity shares of a company at a point of time in future. The Date of Conversion and the Conversion Ratio (number of common equity shares to be received for one CCPS) are predetermined clauses stated in the Terms of Issue. These clauses are mutually agreed between the issuer (promoters/company) and the CCPS investor at the time of issuance.

Why is equity not being issued now but on a later date through conversion?

CCPS benefit the promoters of a company to maintain their say in the business when issuing CCPS due to the lower voting rights associated with CCPS.

However, a CCP Shareholder’s interests are protected as well. When a new PE investor is ready to invest in a company at a higher valuation in future, a CCP shareholder may convert their shares into equity at the predetermined rate (Conversion Ratio) to maintain their stake in the company, without needing to bring in extra money at the higher valuation. A CCP shareholder may also choose to sell their converted Equity to the incoming PE investor, thereby offering themself an attractive exit option; should they wish to exercise it.

That is one reason why promoters are often CCP Shareholders as well. A Promoter who owns CCPS may convert their CCPS issued at a lower valuation when the new investor invests at a higher valuation- thereby maintaining their say without diluting their stake at the higher valuation.

Hence CCPS are an anti-dilutive instrument designed to offer flexibility to promoters and investors.

Any tax implications to consider while investing via CCPS?

While conversion of Preference Shares to Equity is not considered a taxable event, any Preference Dividends received before conversion and any Capital Gains received after conversion are considered taxable events at the appropriate tax rates for Equity investments as per the Income Tax Rules of India. However, the rules on CCPS as hybrid instruments are still unclear and are subject to change over time. Readers are advised to consult their Tax, Legal and Accounting advisors to keep abreast of the latest developments.

For additional reading, check out the links below:

CCPS for Publicly listed Companies

CCPS for Startups